top of page

Search

Deemed Dividend Under India’s Income-Tax Act, 1961

India’s Income-tax Act, 1961 adopts an inclusive and anti-avoidance definition of “dividend” under Section 2(22).

Mayur Bhadani

10 hours ago4 min read

🏛 ITAT Ahmedabad Landmark Ruling -Section 263 Order Passed in Name of Non-Existent Company Held Void

Section 263 Order Passed in Name of Non-Existent Company Held Void

Mayur Bhadani

3 days ago3 min read

Reassessment Notice Quashed by Gujarat High Court

In a significant judgment dated 27 January 2026, the Gujarat High Court quashed a reassessment notice issued under Sections 148A and 148 of the Income Tax Act in the case of Guruvayur Infratech Pvt. Ltd. vs ACIT (AY 2021-22).

Mayur Bhadani

4 days ago2 min read

MAT Overhaul from FY 2026–27: How New Rules Push Companies into the New Tax Regime

Minimum Alternate Tax (MAT) was introduced to tax “zero-tax companies” that reported good profits in books but paid little or no income tax due to exemptions and incentives.

With the Finance Bill, 2026, MAT itself has been re-engineered. The Government now wants most companies to move to the simpler, concessional corporate tax regime (like 22%/15% rates without exemptions).

Mayur Bhadani

Feb 116 min read

MSME Payments & Section 43B(h): The 15/45 Days Rule That Can Increase Your Taxable Income

From FY 2023–24 onwards, delayed payments to Micro & Small enterprises can hit you twice:

Under Income Tax (Section 43B(h)) – expense gets disallowed if you miss the MSME time limit.

Under MSMED Act – you may have to pay hefty compound interest to the MSME supplier.

Mayur Bhadani

Feb 106 min read

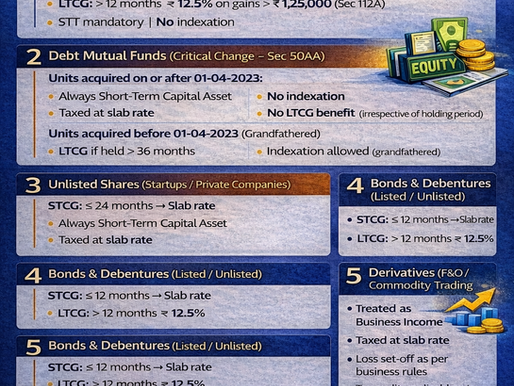

Taxation of Securities in India (FY 2025–26): A Complete & Practical Guide

Investing in securities such as shares, mutual funds, bonds, and derivatives has become common for Indian taxpayers. However, taxation of securities is one of the most misunderstood areas of income tax, and a small classification error can lead to tax demand, interest, penalty, or scrutiny.

Mayur Bhadani

Feb 23 min read

💎 Gold, Diamonds & Jewellery: Wealth Asset or Tax Trap?

In India, gold and jewellery are not just investments — they are emotion, tradition, security, and status.

Mayur Bhadani

Jan 313 min read

🏗️ વૉર્પિંગ મશીન માટે બેઝ કન્સ્ટ્રક્શન અને આયર્ન ગર્ડર પર GST ITC મળશે કે નહીં?

કાયદા, કેસલૉ અને વ્યવહારિક દૃષ્ટિકોણ સાથે સંપૂર્ણ વિશ્લેષણ

Mayur Bhadani

Dec 22, 20252 min read

Startup Tax Holiday under Section 80-IAC vs MAT & Advance Tax

Even when normal tax is NIL, MAT can still be payable.

Mayur Bhadani

Dec 15, 20253 min read

bottom of page