top of page

Search

Deemed Dividend Under India’s Income-Tax Act, 1961

India’s Income-tax Act, 1961 adopts an inclusive and anti-avoidance definition of “dividend” under Section 2(22).

Mayur Bhadani

11 hours ago4 min read

🏛 ITAT Ahmedabad Landmark Ruling -Section 263 Order Passed in Name of Non-Existent Company Held Void

Section 263 Order Passed in Name of Non-Existent Company Held Void

Mayur Bhadani

3 days ago3 min read

Reassessment Notice Quashed by Gujarat High Court

In a significant judgment dated 27 January 2026, the Gujarat High Court quashed a reassessment notice issued under Sections 148A and 148 of the Income Tax Act in the case of Guruvayur Infratech Pvt. Ltd. vs ACIT (AY 2021-22).

Mayur Bhadani

4 days ago2 min read

E-Way Bill: The #1 Mistake Zone—Delivery Challan vs Tax Invoice (Especially for Branch Transfers)

If your goods are moving on roads, the GST department usually checks only two things first: What document is travelling with goods (Tax Invoice / Bill of Supply / Delivery Challan / Bill of Entry), and Whether the e-way bill data matches that document.

Mayur Bhadani

5 days ago4 min read

MAT Overhaul from FY 2026–27: How New Rules Push Companies into the New Tax Regime

Minimum Alternate Tax (MAT) was introduced to tax “zero-tax companies” that reported good profits in books but paid little or no income tax due to exemptions and incentives.

With the Finance Bill, 2026, MAT itself has been re-engineered. The Government now wants most companies to move to the simpler, concessional corporate tax regime (like 22%/15% rates without exemptions).

Mayur Bhadani

Feb 116 min read

MSME Payments & Section 43B(h): The 15/45 Days Rule That Can Increase Your Taxable Income

From FY 2023–24 onwards, delayed payments to Micro & Small enterprises can hit you twice:

Under Income Tax (Section 43B(h)) – expense gets disallowed if you miss the MSME time limit.

Under MSMED Act – you may have to pay hefty compound interest to the MSME supplier.

Mayur Bhadani

Feb 106 min read

Government Subsidies for Food & Agriculture Businesses in India

India’s food and agriculture sector is one of the most incentivised sectors under Government policy. From micro food units to large processing plants and cold chains, multiple Central and State subsidy schemes are currently operational to promote value addition, reduce post-harvest losses, and formalise the food ecosystem.

Mayur Bhadani

Feb 34 min read

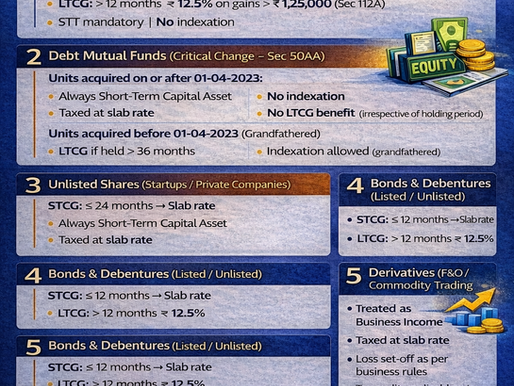

Taxation of Securities in India (FY 2025–26): A Complete & Practical Guide

Investing in securities such as shares, mutual funds, bonds, and derivatives has become common for Indian taxpayers. However, taxation of securities is one of the most misunderstood areas of income tax, and a small classification error can lead to tax demand, interest, penalty, or scrutiny.

Mayur Bhadani

Feb 23 min read

💎 Gold, Diamonds & Jewellery: Wealth Asset or Tax Trap?

In India, gold and jewellery are not just investments — they are emotion, tradition, security, and status.

Mayur Bhadani

Jan 313 min read

Taxation of Gifts under Income Tax Act (Section 56(2)(x))

🎁 Taxation of Gifts under Income Tax Act (Section 56(2)(x)) ❗ Gift = Income? YES, Sometimes Many people believe gifts are always tax-free. 👉 Wrong assumption — wrong reporting leads to notices & penalties . 🔍 What Does the Law Say? If a person receives money, property or assets without consideration or for inadequate consideration , it may be taxable as “Income from Other Sources” . 💰 Gift in Cash 🟢 Not taxable if total gifts ≤ ₹50,000 in a financial year 🔴 Taxable i

Mayur Bhadani

Jan 292 min read

“Bill Ship-to” Transactions under GST – One Mistake = ITC Loss

🔍 What is a Bill-to Ship-to Transaction? A transaction where: 📄 Invoice (Bill-to) is raised on one party 🚚 Goods (Ship-to) are delivered to another party 👉 Very common in trading, EPC, textile, and inter-state deals ⚖️ Legal Provision As per Section 10(1)(b) of the CGST Act, 2017 ➡️ It is treated as two separate supplies for GST purposes. 🔄 How the Transaction Works 1️⃣ Seller → Bill-to Party (Deemed supply) 2️⃣ Bill-to Party → Ship-to Party (Actual delivery) ✔️

Mayur Bhadani

Jan 281 min read

🚨 Reassessment Cannot Be Based on Suspicion Alone

What is disclosed and taxed cannot be treated as “income escaping assessment”.

Mayur Bhadani

Dec 26, 20253 min read

🏗️ વૉર્પિંગ મશીન માટે બેઝ કન્સ્ટ્રક્શન અને આયર્ન ગર્ડર પર GST ITC મળશે કે નહીં?

કાયદા, કેસલૉ અને વ્યવહારિક દૃષ્ટિકોણ સાથે સંપૂર્ણ વિશ્લેષણ

Mayur Bhadani

Dec 22, 20252 min read

Startup Tax Holiday under Section 80-IAC vs MAT & Advance Tax

Even when normal tax is NIL, MAT can still be payable.

Mayur Bhadani

Dec 15, 20253 min read

⚠️ CBDT Issues Strong Warning on Bogus Deductions – What Every Taxpayer Must Know (Dec 2025)

On 13th December 2025, the Central Board of Direct Taxes (CBDT) released an important Press Release that every taxpayer in India must read carefully.

Mayur Bhadani

Dec 13, 20253 min read

Understanding Income Tax In India – A Practical Guide For Taxpayers (updated 2025)

Understanding Income Tax In India – A Practical Guide For Taxpayers (updated 2025)

Mayur Bhadani

Dec 13, 20253 min read

Gujarat High Court Invalidates Time-Barred Section 148 Notice

Gujarat High Court Invalidates Time-Barred Section 148 Notice

Mayur Bhadani

Dec 12, 20252 min read

Vivek Industries vs ITO (ITAT Visakhapatnam)Capital Gains – Assessment in Hands of the “Right Person”

A partnership firm’s ownership and tax liability continue until it is legally dissolved. The sale of a firm’s property must be taxed in the firm’s hands, not in the hands of its partners, even if the business has been discontinued.

Mayur Bhadani

Dec 11, 20253 min read

Deadline for late fee amnesty under GST extended till November 30, 2021

#CBIC #GST #GSTamnesty #Breaking #Relief #Notification #pressrelease #GSTR1 #GSTR3B The CBIC vide Notification No. 19/2021- Central Tax,...

Mayur Bhadani

Aug 30, 20212 min read

Govt. has further extended the exemption from Custom Duty/health cess on import of Covid relief item

#IndiaFightsCOVID19 #Notification #CBEC #import #customduty #cess #relief The Central Government, on being satisfied that it is necessary...

Mayur Bhadani

Aug 30, 20211 min read

bottom of page