Reassessment Notice Quashed by Gujarat High Court

- Mayur Bhadani

- 5 days ago

- 2 min read

Important Relief for Taxpayers under Section 148

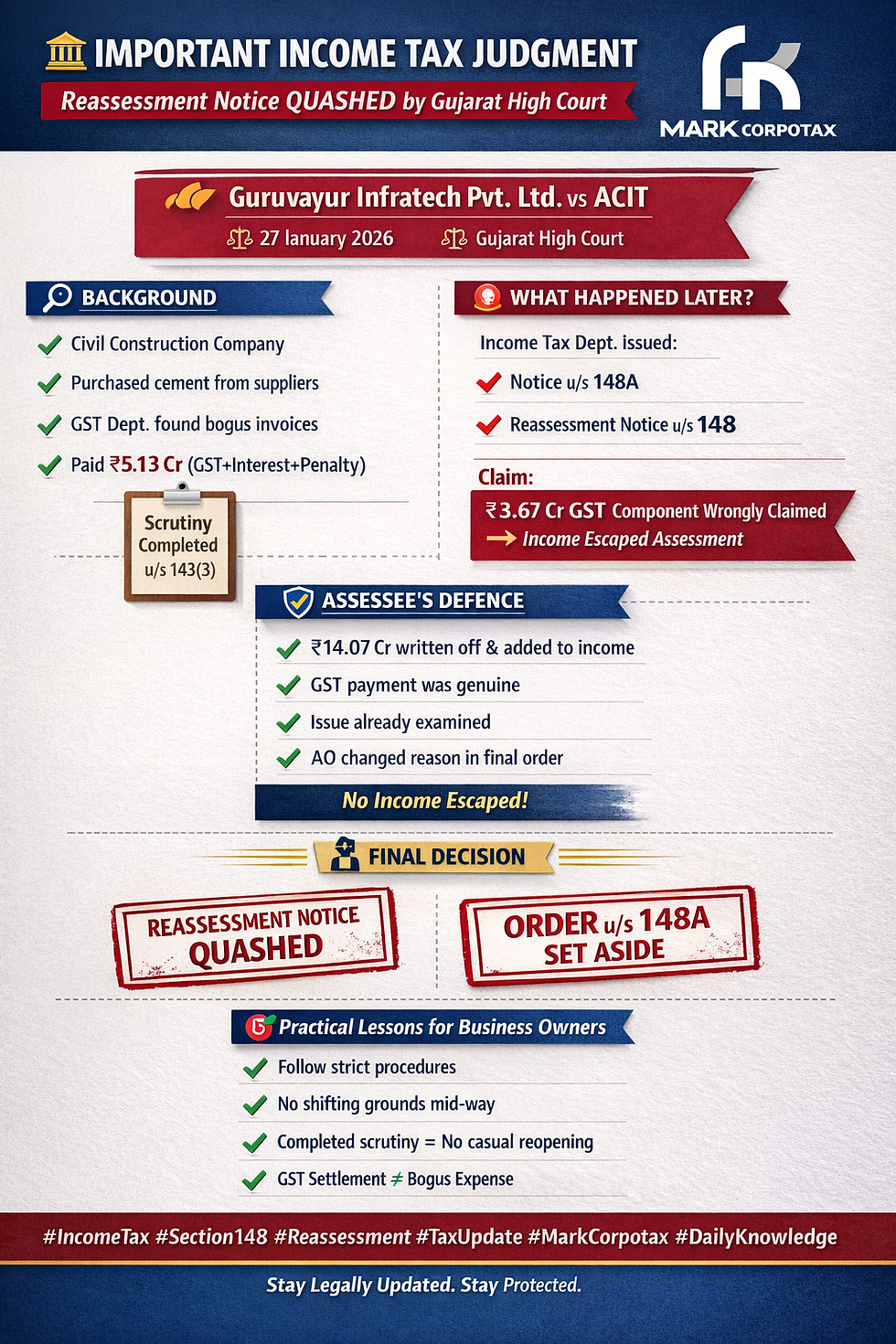

In a significant judgment dated 27 January 2026, the Gujarat High Court quashed a reassessment notice issued under Sections 148A and 148 of the Income Tax Act in the case of Guruvayur Infratech Pvt. Ltd. vs ACIT (AY 2021-22).

This ruling provides strong protection to taxpayers against improper reopening of completed assessments.

Background of the Case

The assessee, a civil construction company, had entered into cement purchase transactions during FY 2020-21. Subsequently, the GST Department (DGGI) conducted a survey and found that certain suppliers were issuing bogus invoices.

To avoid prolonged litigation, the company:

Reversed GST credit

Paid GST along with interest and penalty

Total payment made: ₹5.13 Crore (via DRC-03)

The company filed its income tax return, and the case was selected for scrutiny. After detailed examination, assessment was completed under Section 143(3).

What Triggered Reassessment?

Later, the Income Tax Department issued:

Notice under Section 148A

Reassessment notice under Section 148

The department alleged that ₹3.67 Crore (GST component) was wrongly claimed as expenditure, resulting in income escaping assessment.

Assessee’s Key Arguments

The company demonstrated that:

₹14.07 Crore relating to the supplier was written off and added back to income — not claimed as deduction.

The GST payment was a genuine settlement payment made after DGGI action.

The issue had already been examined during original scrutiny.

The Assessing Officer changed the basis of reopening while passing the final order.

High Court’s Observations

The Gujarat High Court held:

The Assessing Officer cannot travel beyond the original show cause notice.

A new allegation cannot be introduced without giving proper opportunity.

Reopening on a mere change of opinion is invalid.

There was no material to show income had actually escaped assessment.

Accordingly, the Court quashed the reassessment notice and set aside the order under Section 148A.

Why This Judgment Is Important

This ruling reinforces key legal safeguards:

1️⃣ Strict Compliance Required in Reopening

Reassessment proceedings must strictly follow statutory procedure.

2️⃣ No Change of Opinion

If an issue is examined during scrutiny, it cannot be reopened casually.

3️⃣ Opportunity of Hearing Is Mandatory

Taxpayers must be informed clearly about allegations before final order.

4️⃣ GST Settlement Payments Need Proper Evaluation

Payment made after GST investigation does not automatically become bogus expenditure.

Practical Guidance for Businesses

If you receive a notice under Section 148 or 148A:

Carefully examine whether the issue was already scrutinized.

Check whether the department has changed the grounds midway.

Verify whether proper opportunity was provided.

Respond with detailed reconciliation and documentation.

Improper reassessment notices can be successfully challenged when procedure is not followed.

Comments