MSME Payments & Section 43B(h): The 15/45 Days Rule That Can Increase Your Taxable Income

- Mayur Bhadani

- Feb 10

- 6 min read

Introduction

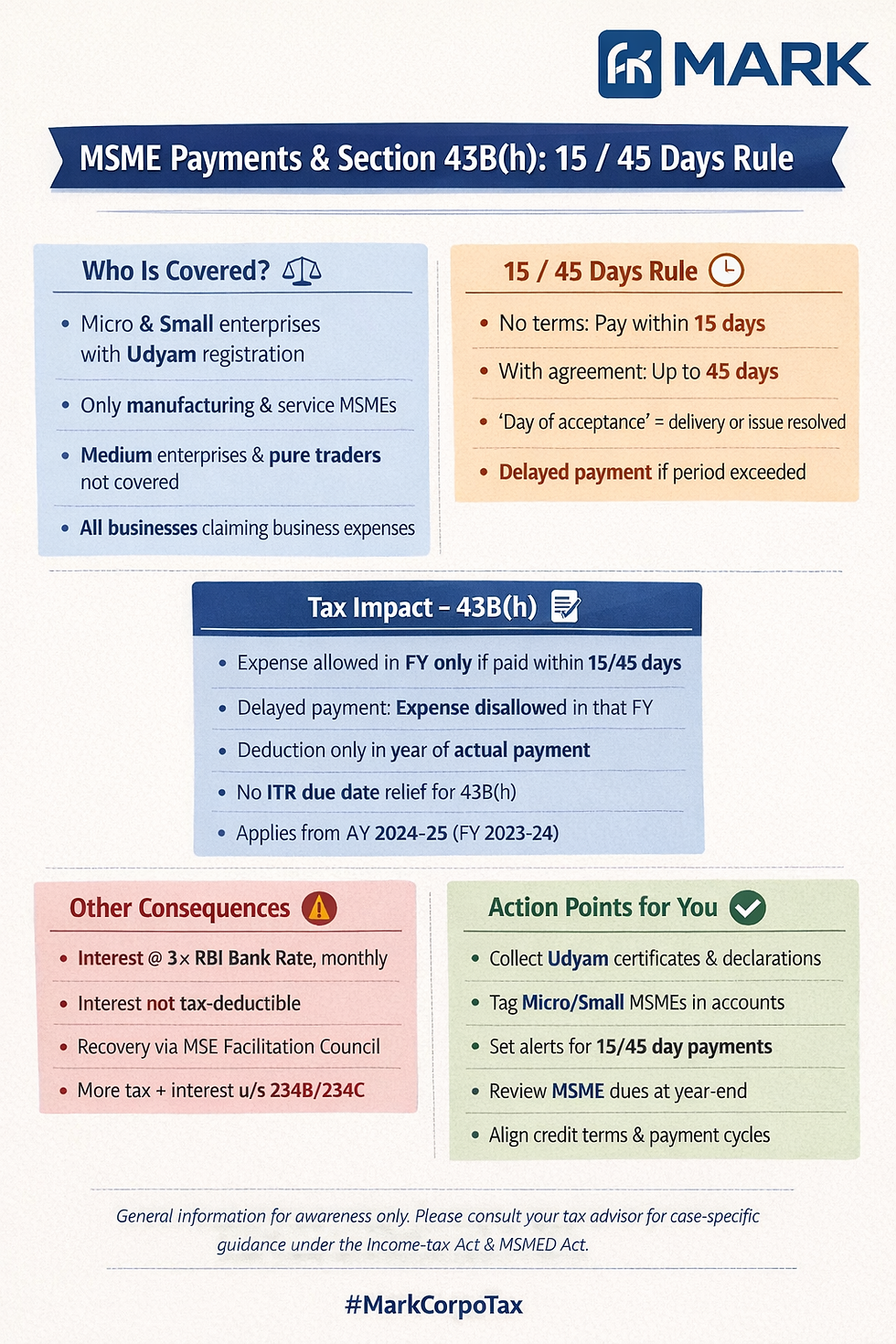

From FY 2023–24 onwards, delayed payments to Micro & Small enterprises can hit you twice:

Under Income Tax (Section 43B(h)) – expense gets disallowed if you miss the MSME time limit.

Under MSMED Act – you may have to pay hefty compound interest to the MSME supplier.

For business owners, this is no longer a “small compliance point”. It directly impacts P&L, cash flow and tax outgo.

This article explains, in plain language, how MSME payments and Section 43B(h) work together and what you should change in your payment systems right now.

1. Legal Background – Two Laws Working Together

MSMED Act, 2006 – Payment timelines (Section 15)

Buyer must pay a micro or small enterprise:

Within the agreed credit period in writing, but maximum 45 days from the day of acceptance/deemed acceptance; or

Within 15 days from the day of acceptance/deemed acceptance, if no written agreement exists.

Income-tax Act, 1961 – Section 43B(h)

A new clause (h) is inserted in Section 43B w.e.f. 1 April 2024, applicable from AY 2024–25 (i.e. FY 2023–24 onwards).

It says: any sum payable to a micro or small enterprise, beyond the MSMED time limit, is allowed as a tax deduction only in the year of actual payment.

Also, the proviso to Section 43B is amended to exclude clause (h) – which means you cannot save the deduction by paying up to the ITR due date; you must pay within 15/45 days itself.

2. Who is Covered? – Buyer & Supplier Tests

2.1 Which suppliers are covered?

Only payments to “micro” or “small” enterprises are covered, as defined in the MSMED Act and as updated by the Ministry of MSME.

As per the revised central classification w.e.f. 1 April 2025:

Micro enterprise

Investment in plant & machinery/equipment: ≤ ₹2.5 crore

Annual turnover: ≤ ₹10 crore

Small enterprise

Investment: ≤ ₹25 crore

Turnover: ≤ ₹100 crore

Important: For Section 43B(h), the legal meaning of “micro” and “small” comes from the MSMED Act & notifications, not from private bank/fintech definitions.

In practice, a supplier will be treated as covered if:

It has valid Udyam registration as a micro or small enterprise (manufacturing or services); and

It qualifies as a “supplier” under the MSMED Act (registered micro/small enterprise).

2.2 Are traders covered?

MSMED Act’s basic definition of “enterprise” covers manufacturing and services, not pure trade.

An Office Memorandum allowed wholesale and retail traders to obtain Udyam for Priority Sector Lending only, but they are not treated as “enterprises” for other MSME benefits.

Therefore, the conservative and widely accepted view is:

Section 43B(h) applies only to manufacturing and service MSMEs, not to traders, even if they show a Udyam number meant only for bank lending.

2.3 Which buyers are covered?

Almost all businesses claiming deduction of expense are covered:

Companies, LLPs, firms, proprietors

Regardless of whether the buyer itself is an MSME or not

Section 43B(h) applies to business income (Section 28) – not to purely personal expenses.

3. The 15 / 45 Days Rule – How to Count Correctly

The MSMED Act uses some specific terms:

Day of acceptance = day goods/services are actually delivered, or the day you resolve a written objection raised within 15 days.

Day of deemed acceptance = if you don’t send a written objection within 15 days, the delivery date itself.

From this date, you decide the time limit:

No written agreement on credit period

You must pay within 15 days from the day of acceptance/deemed acceptance.

Written agreement exists

You must pay on or before the agreed date, but

That agreed period cannot exceed 45 days from the day of acceptance/deemed acceptance.

If you cross these limits, you violate Section 15 and the MSME can claim interest under Section 16 and also file a case with the MSE Facilitation Council (Samadhaan portal).

4. How Section 43B(h) Works for Tax

4.1 Basic rule

For payments to eligible Micro/Small suppliers:

If paid within the MSME time limit (15/45 days)

Expense is allowed in the same financial year in which it is booked (normal accrual principle continues).

If paid after MSME time limit

Expense is disallowed in that year.

It will be allowed only in the year in which actual payment is made.

Also:

The usual “paid before ITR filing due date” relief in the proviso to Section 43B does not apply to clause (h).

4.2 Simple examples

Example 1 – Within limit (deduction allowed in same year)

MSME invoice date & acceptance: 10 January 2025

Written agreement: 30 days credit

Latest permissible date (within 45 days): 9 February 2025

Actual payment: 5 February 2025

Result:

Payment is within MSME limit, so expense is allowed in FY 2024–25 itself.

Example 2 – Beyond limit (disallowance)

MSME invoice date & acceptance: 10 January 2025

Written agreement: 30 days credit

Latest permissible date: 9 February 2025

Actual payment: 20 April 2025

Result:

Payment crosses the MSME limit of 45 days.

Expense relating to this invoice is disallowed in FY 2024–25.

It will be allowed as deduction only in FY 2025–26, when payment is actually made.

Example 3 – No written agreement

MSME invoice date & acceptance: 1 March 2025

No written credit terms

You must pay within 15 days, i.e. up to 16 March 2025.

If you pay on 30 April 2025, deduction is pushed to FY 2025–26.

5. Common Mistakes & Practical Issues

Treating “any MSME” as covered

Section 43B(h) applies only to micro & small enterprises, not to medium enterprises.

Assuming traders are covered

As discussed, pure traders are generally not “enterprises” under MSMED Act – a frequent mistake in ERP tagging.

Using “ITR due date” logic

Many businesses think: “I’ll pay by 31 October and claim deduction for last year.”

Under 43B(h) this is wrong – if you miss 15/45 days, you lose deduction for that year, even if you pay before ITR filing.

Ignoring MSME reclassification from 1 April 2025

Thresholds for micro/small/medium are enhanced from 2025, so some suppliers may move into “small” or “medium” category.

Your vendor master must be updated annually based on latest Udyam data.

Not obtaining proof of MSME status

Merely printing “MSME” on invoice is not enough.

Auditors will expect Udyam certificate or declaration to support 43B(h) working.

Not tracking “day of acceptance”

Tax teams often use invoice date or GRN date blindly.

But MSMED Act definitions can change the counting of 15/45 days where objections are raised.

Interest on delayed payment claimed as expense

Interest payable under Section 16 r.w. Section 23 of MSMED Act is expressly not deductible under Income Tax.

6. Penalties, Interest & Consequences

Higher taxable income

Disallowed MSME expenses are added back in tax computation, increasing taxable profit.

Interest under Income-tax Act

Higher tax leads to interest u/s 234B/234C for short payment/short advance tax.

Reporting in Tax Audit (Form 3CD)

CBDT has amended Form 3CD to separately report disallowance under Section 43B(h) and interest under MSMED Act.

Interest under MSMED Act

Buyer must pay compound interest with monthly rests at three times the RBI bank rate on delayed amounts.

Legal & reputational risks

MSMEs can approach MSE Facilitation Council (Samadhaan portal) for recovery; orders are enforceable like decrees.

7. Practical Tips from a CA’s Desk

Vendor classification exercise

Identify all MSME vendors and obtain:

Udyam Registration Certificate

Written declaration of micro/small status & business type (manufacturing/service/trade).

Update ERP / accounting system

Create a specific “MSE” flag for eligible vendors.

Configure automatic calculation of the MSME due date (15/45 days).

Generate a monthly ageing report for MSME payables.

Change credit policies

For MSMEs, avoid giving long credit periods; keep it ≤ 45 days or shorter.

Where possible, structure supplies on advance / part-advance basis.

Synchronise with Tax & Treasury

Finance and accounts should have a standard cut-off (e.g., weekly payment run) to ensure MSME invoices are cleared well before the 15/45 days limit.

Audit trail & documentation

Keep copies of written objections, acceptance notes, GRNs etc., to prove “day of acceptance” if ever questioned.

Review outstanding as on 31 March every year

Before year-end, identify MSME invoices at risk of disallowance and plan timely payments where feasible.

8. Key Takeaways for Business Owners

Section 43B(h) is now a permanent feature – not a temporary relaxation.

It applies only to payments to micro & small enterprises for goods/services, within MSMED Act definitions.

15 days applies when there is no written credit agreement; otherwise maximum 45 days.

If you miss the MSME due date, you lose tax deduction for that year, even if you pay before filing your ITR.

Traders and medium enterprises are generally outside Section 43B(h), but you must classify vendors carefully.

MSME interest under MSMED Act is non-deductible and can be very expensive.

A one-time clean-up of vendor data and payment processes can save significant tax and interest every year.

Comments